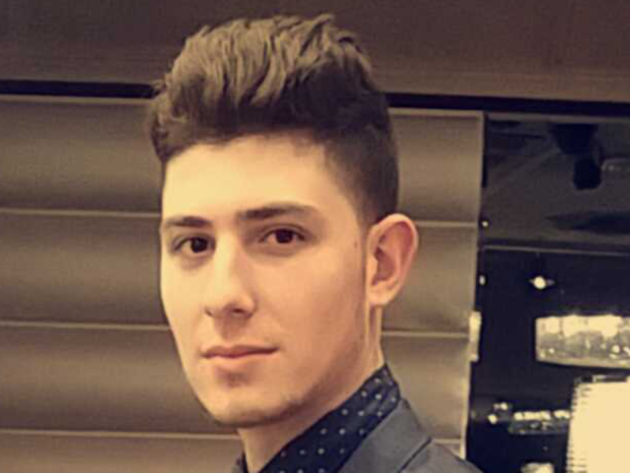

Steve Keranas had the perfect investment property – huge capital gains, a reliable tenant and not a cent spent on maintenance. Yet he decided to throw it all away to achieve his ambitious goal.

“Sometimes you need to be bold and brave in property investment.

I’m an ambitious investor, with clear goals. I knew I wanted to invest in property from the age of 16, and I worked hard and saved so I could buy my first property at 18.

I want to retire by the time I’m 30 years old, and I knew that I risked getting too comfortable and losing sight of my goals if I just sat on my first two investment properties – in Lakemba and San Souci.

Then my Dad pointed out an opportunity too good to refuse. A commercial investment opportunity next to Wynyard Station in Sydney’s CBD. It was one shop, but there was potential to split it into two separate shops – effectively doubling any income opportunities.

My Dad’s always been a bit of an inspiration when it comes to my property investment. Looking at his portfolio growing up was part of the motivation behind starting my own investment portfolio at such a young age, so I was inclined to trust his judgement on this place.

But buying the shop would mean giving up one of my other investment properties. The house in Lakemba, purchased when I was 18, was a bit of a wreck, but the tenant had always been reliable.

I hadn’t needed to spend a cent on maintenance since purchasing it, as the tenant was the same person who had owned the place previously.

My unit in San Souci was in much better condition, but I’d bought it later and it hadn’t seen as much capital growth as Lakemba.

The Lakemba property was such a comfortable hold for me, but I had to face reality. The market had boomed since I’d purchased it and the house value had almost doubled in that time. But it didn’t feel like there was anywhere left to go – there was no chance of developing on the block and the ancient house would need to be replaced at some stage.

On the other hand, I had a clear opportunity to double my money in a matter of months, instead of waiting for another three years and praying for whatever residential market I purchased in to boom.

My preference is to hold onto my residential properties and simply draw on their equity, but the expenses of buying a commercial property were simply too much for that strategy to work.

You need a 30 to 40 per cent deposit to buy commercial, plus GST. It’s not like a residential property where you can just put down 10 or 20 per cent.

I bit the bullet and decided to buy the shop and sell in Lakemba. I nervously turned up to the commercial auction, preparing to be outbid by someone more experienced.

But I had a lucky break – not many people were there and those who were seemed even less experienced than me. I managed to secure the property and I’m preparing to settle on it within the next six weeks.

The plan is to develop the space into two shops and then sell them on, before searching for another similar opportunity. The only exception to that will be if receive a decent offer in terms of weekly rent, then I might hold on to them for a little longer.

That’s the plan. I’m yet to tell whether my decision to sell in Lakemba was the right one but I do know one thing for sure – you don’t retire at 30 without taking some risks along the way.”

Read more:

The most discounted property in Australia