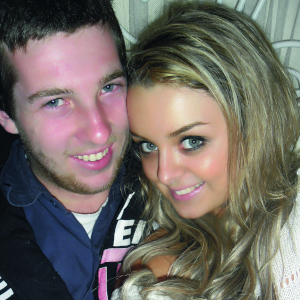

Phoebe and Carl have purchased their first investment property, but have only a handful of weekends to spare to complete their renovation before their tenants move in.

“Buying our first investment property was a smooth experience, renovating it has been a whole lot tougher.

Five months after purchasing our two-bedroom, ocean-view house in Horsfield Bay on the Central Coast of New South Wales, we already have a tenant lined up, but the renovation work is holding us up and costing us money as each day goes by.

On the other hand, we don’t want to rush the renovations too much. We got the property for a steal at $392,000, and an almost-identical renovated property in the area recently fetched $590,000 – so we think there’s plenty of room for capital growth if we focus on doing a high-quality renovation. The equity we gain from this property will form the basis of any future investment, so we need to do it right!

Priced out of Western Sydney, we turned to the Central Coast for our first investment purchase. As my partner, Carl, is a carpenter, we wanted to renovate for profit and had been advised to buy as close as possible to home in order to mitigate any associated problems. We ended up looking at the area for its mix of affordability and the future boost to the local economy promised by infrastructure projects and the relocation of public service jobs.

We’ve spent about $20,000 since we started renovating in February and I’d estimate that we’re around 65 per cent of the way through the work. We’ve done the most costly jobs, including repairing ceilings and replacing a rotting deck, but we’re going to need every spare hour possible to have it finished in time for July. With this in mind, it’s a good thing we don’t mind spending time with one another.

To be able to do something like this with your best friend is amazing. Being with him every weekend isn’t a worry at all. If you are going to do something like a renovation project you need to be more than just romantically involved, you need to be friends too.

Having the responsibility of having a home loan has really opened our eyes up, as has the whole process of purchasing and maintaining a property. When we bought we didn’t even think about things like stamp duty, solicitors fees and water and council rates.

But that’s all part of investing – you have to make sacrifices. We’re young, we have a strong relationship and we can cope with it, and in the long term we know it’s going to pay off.”